Do you have pet insurance? If so, it may be worthwhile to understand how where you live can affect your costs. Each state has its own factors that can impact the cost of your pet insurance premium—from regulations and coverage options to the number of claims filed in each area. In this blog post, we’ll explore how your state affects Pet Insurance costs and provide an understanding of what factors play a role in those decisions. We’ll also look at how renters or homeowners in each region might be affected by their insurance situation too.

The Difference Between Pet Health Insurance and Pet Liability Insurance:

As pet owners, we all want to ensure the health and safety of our furry friends. That's why it's important to understand the difference between pet health insurance and pet liability insurance. Pet health insurance typically covers the cost of veterinary care and treatment for illnesses and injuries, while pet liability insurance protects you financially if your pet injures someone or damages someone's property. It's important to carefully consider both types of insurance to ensure that you are providing the best possible protection for your pet and yourself. By understanding the difference between these two types of insurance, you can make a well-informed decision for your pet's overall well-being.

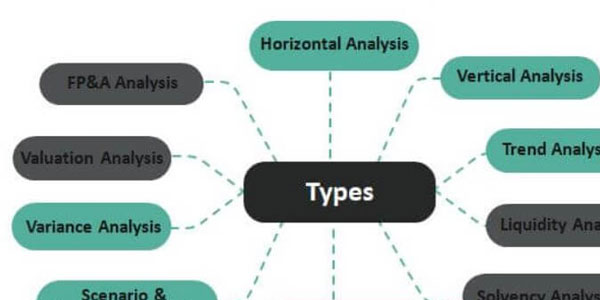

How State Laws Affect Pet Insurance Coverage?

Pet insurance coverage is an essential aspect of pet ownership that has grown increasingly popular in recent years. State laws play a crucial role in determining the scope of pet insurance policies offered to pet owners all across the country. Some states have more extensive regulations than others, while some have virtually no regulations at all. These laws affect critical aspects of pet insurance policies such as coverage limits, pre-existing condition exclusions, and reimbursement rates. As a result, it is essential to understand how state laws affect pet insurance coverage to make informed decisions about getting the right policy for your furry friend.

Things to Consider When Choosing a Pet Health Insurance Policy:

As a pet parent, it can be difficult to know where to start when it comes to choosing a health insurance policy for your furry friend. After all, you want to make sure you are getting the best coverage possible while also staying within your budget. When considering different policies, it is important to take into account factors such as deductibles, annual limits, and pre-existing conditions. You may also want to look into any additional coverage options, such as wellness exams or behavior therapy.

By doing your research and carefully evaluating your options, you can find a pet health insurance policy that gives you peace of mind and keeps your beloved companion healthy and happy.

Common Questions About Pet Insurance & State Regulations:

Pet insurance can be a confusing topic for many pet owners, but it doesn't have to be. As with any insurance, it's important to understand what factors are involved in determining coverage and how state regulations come into play. Some common questions pet owners have about pet insurance include:

- What does pet insurance cover?

- How much does it cost?

- What is the difference between accident-only and comprehensive coverage?

Additionally, it's important to be aware of state regulations regarding pet insurance, as they can vary from state to state. Some states may require pet insurance companies to offer certain coverage options or may regulate the maximum amount a company can charge for premiums. By arming yourself with knowledge about pet insurance and state regulations, you can make informed decisions about what coverage is best for you and your furry friend.

Ways to Save Money on Your Pet Health Insurance:

As a pet owner, you undoubtedly want the best medical care for your furry friend, but pet health insurance can be quite expensive. However, there are ways to save some money on it. Firstly, consider a higher deductible. You will pay less each month, while still having a safety net in case of emergencies. Additionally, signing up for a group plan can save you as much as 10-15%. Another way to save money is by checking if your employer or any organizations you are affiliated with offer pet insurance discounts. Lastly, always compare prices between different pet insurance providers and choose the one that is most affordable yet still offers the coverage your pet needs. By following these tips, you can ensure that your pet stays healthy without burning a hole in your wallet.

Conclusion:

Pet insurance is an important decision for any pet owner, and understanding state regulations and how they affect your policy can help ensure that you are making the best choice based on the needs of both you and your pet. To make sure you’re getting the most value out of your coverage, it’s important to understand what is covered under your plan, as well as ways in which you can save money and ensure that it fits within your budget. With a bit of research, finding the right pet health insurance policy for you doesn't have to be complicated or stressful - so go ahead and get started on finding options that meet YOUR needs today!

FAQs?

1. How does my state affect the cost of my pet insurance?

Different states have varying regulations and laws concerning pet insurance. These rules can influence factors such as coverage limits, pre-existing condition exclusions, and reimbursement rates. As such, the cost of pet insurance may vary from state to state.

2. Can I buy pet insurance from another state if it is cheaper?

Typically, you cannot buy pet insurance from another state. Pet insurance policies are generally regulated by the state the policyholder resides in, meaning you must purchase a policy that adheres to your own state's laws and regulations.

3. Will moving to a different state affect my current pet insurance policy?

If you move to a different state, your pet insurance policy may be affected. Some providers may adjust your premiums based on the new location or the change might affect the coverage of your policy due to different state laws. It is advisable to contact your insurance provider to understand the potential impacts of a move.

4. Do all states regulate pet insurance the same way?

No, each state has its own regulations and laws regarding pet insurance. Some states have extensive regulations, while others may have minimal ones. This variation in regulations contributes to the differences in pet insurance policies and costs across states.