The Green Dot card is a reloadable, prepaid debit card that may be used anywhere Visa is accepted, including ATMs, and is protected by the FDIC. Green Dot cards can be purchased at stores like Wal-Mart, CVS, and Rite Aid. The monthly charge for the Green Dot Prepaid MasterCard or Visa is less than that of certain other prepaid debit cards issued by Green Dot.

Do you want to know how to maximise the benefits of this card? Mastering the art of budgeting and saving with a prepaid debit card

Paying bills online or using a mobile device is free. Direct deposits to your phone are free. Merchants typically accept Visa and MasterCard. Need to establish or improve your credit history instead? Discover the basics of secured credit cards.

Negatives of the Green Card

The monthly charge is a hefty $7.95 (but is waived with monthly deposits of $1,000 or more). There is not any kind of free ATM system available. In addition to whatever costs the ATM owner may impose, there is a $3 fee to use the machine. It may cost you up to $5.95 at the register to load money onto your card. It will set you back $3 to get cash from a teller.

Obtain a dozen checks for $5.95. Are you ready to switch to more conventional means of saving? View Top High-Interest Savings Accounts Brief Introduction to Prepaid Debit Cards

An explanation of what a prepaid debit card is

A prepaid debit card is a payment option that can only be used to make purchases up to the amount stored on the card. Credit scores aren't affected in any way by them. Compared to spending cash, it's much safer and easier to use this method. Prepaid cards typically include an accompanying app that allows users to deposit checks and transfer funds. Check out our prepaid debit card FAQ for more info.

Prepaid debit cards differ from traditional checking accounts because they don't always provide access to banking amenities like free ATM withdrawals and paper checks. Check out. We recommend checking accounts if that doesn't work for you. You can also look for a second chance checking accounts if you've had trouble with banks in the past.

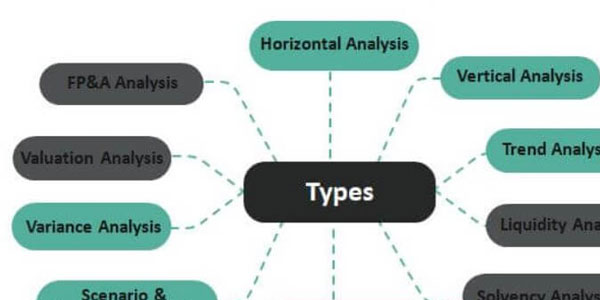

What are the differences between a prepaid debit card, a debit card, and a credit card?

Purchase your prepaid debit card before: Before making purchases, you must add funds to the card using cash, cheques, direct deposit, or an existing bank account. Credit cards — later payment option Direct withdrawals and payments from an ATM or shopping are made using funds from a checking account.

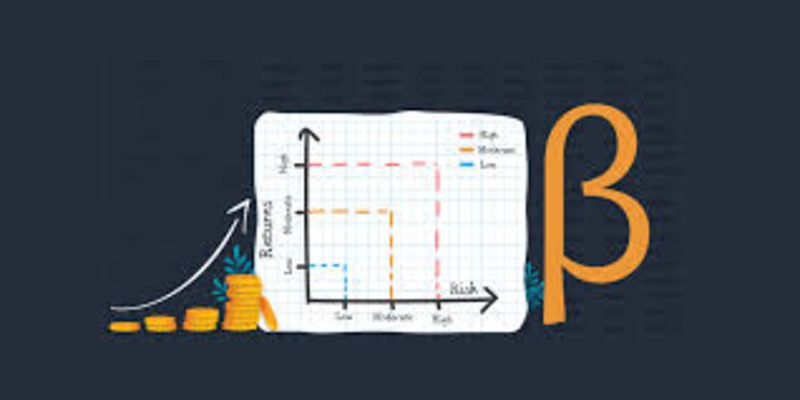

The Federal Deposit Insurance Corporation (FDIC) insures prepaid cards, but how does it work? If your prepaid debit card issuer goes bankrupt, the FDIC will step in and protect your funds. Therefore, a prepaid card is either issued by a bank or maintained by a prepaid card company partnered with a bank to offer FDIC insurance. To receive benefits like FDIC insurance and other safeguards, prepaid debit cards must be registered in the cardholder's name.

Prepaid credit cards like Green Dot's Mastercard and Visa are an option for those who would prefer not to undergo a credit check or who are unable to create a regular checking account. While using a Green Dot prepaid card won't help you establish credit, it will allow you to make purchases in a world where credit is less necessary.

Prepaid cards function similarly to debit cards used with checking accounts. Green Dot cards are branded with a major credit card processing network. Once funded with your choice of Mastercard or Visa, it can be used virtually anywhere major credit cards are accepted.

Green Dot Costs and Functionality

A Green Dot prepaid card can be used for regular expenses like groceries and gas, internet purchases, and bill payments. No minimum balance is needed, and your preloaded funds are safe from fraud.

Unlike generic cards, which can cost up to $4.95, personalising an online order of greeting cards costs you nothing. A branded card will likely be required when making recurring purchases, renting a car, or booking a hotel room.

Having your paycheck directly deposited or using the mobile check deposit option with the Android or iPhone app are free ways to add funds to a card. It's easy to get your money onto your Green Dot card by simply photographing the front and back of your check with the app. Depending on the bank, there could be a processing time that prevents you from accessing your money for one or more working days.