One often sets financial objectives to prepare financially for retirement and then decides how best to save and invest. When it comes to saving for retirement, many financial experts recommend following extremely particular formulae and procedures. However, it's essential to stand back and look at the broad picture every once in a while to make sound investing decisions.

Learn About Some Reliable Investment Options

While there is no such thing as a completely safe investment, the five listed below are often regarded as some of the most secure options. Bank savings accounts and certificates of deposits usually are FDIC-insured.

In other words, Treasury securities are debt obligations guaranteed by the federal government. Fixed annuities typically have guarantees written into their contracts, and money market accounts are considered among the safest investments. If the insurance company goes bankrupt, an annuity provides some financial security for the beneficiary.

The safety of your principal is the primary goal of these automobiles. Making interest payments is a secondary goal. You shouldn't expect huge profits from these investments, but you shouldn't lose money.

Master the Concept of Safety

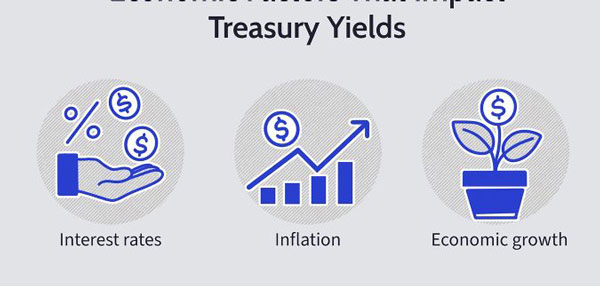

Even the most conservative investments may go wrong. There are three categories of risk associated with safe investments: the loss of principle, the erosion of buying power owing to inflation, and the danger of illiquidity resulting from surrender costs or extended maturities.

Keep in mind that the purchasing power of your cash may decrease if you put it in a bank deposit box or other secure location. This is because it has not grown in value over time. Even if it hasn't depreciated, playing it too cautious might cause it to lose purchasing power. You'll also want to have some money invested for growth over the long run.

How Much To Invest In Safe Bets

Keep spending three to six months in secure investments in an emergency. The more precarious your job situation is, the more money you'll want to stash away in an emergency fund. As retirement approaches, preserving savings in stable, low-risk assets becomes more critical.

A retirement income estimate can help you decide how much to set aside in secure assets as you approach retirement. With the aid of a financial counselor, you may create a projection to determine the timing and amount of withdrawals you will need to make. Then, you may coordinate your withdrawal requirements with the safe investments you've made.

Create Reasonable Predictions About Your Return

How much, roughly speaking, can you anticipate earning from safe investments, or what type of returns can you anticipate seeing? It fluctuates from year to year. Returns on safe investments would have varied from 6.73% in 2000 to 0.10% in 2021.

With interest rates at record lows, safe assets are unlikely to yield much money.2 To increase your profit chances, you should diversify your portfolio.

The Way To Recognize and Avoid Poor Investments

Recognizing and avoiding risky assets is essential for a successful investment strategy. If you are aware of what to look for, you may prevent many poor investments. For instance, you should avoid assets with excessive fees and harsh surrender costs.

Investing is a long-term process; you should not put money into anything that guarantees you a return within the next day without doing your homework. Please don't put your money into something nobody can explain to you since it's probably not worth it. The key to a happy retirement might be avoiding common pitfalls.

Provisions For Assured Income In Retirement

Guaranteed retirement income is similar to safe investing, even though it is not an investment per se. After all, it's hard to imagine a safer option than a guarantee. Social Security, pensions, and annuities are the main dependable income streams. These options are a great starting point for building a safe retirement savings strategy.

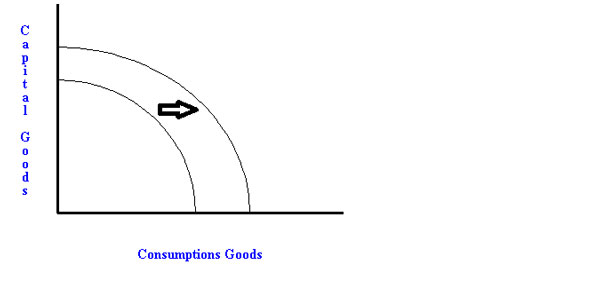

There should be some allocation of your portfolio to safe assets, but being overly cautious might be detrimental to your returns. The longer your savings have to grow, the longer they will last in your retirement.

If you start playing it safe with your investments too quickly, you can miss out on rewards that could have been had with a slightly higher level of risk. Consult a reliable financial planner about your risk tolerance.

Conclusion

Learning about your investing options, beginning planning early, controlling your emotions, and getting help when you need it may all increase your chances of having a secure financial future. Investing criteria, such as "you need 20 times your gross yearly income to retire" or "save and invest 10% of your pretax income," may help you fine-tune your retirement approach.