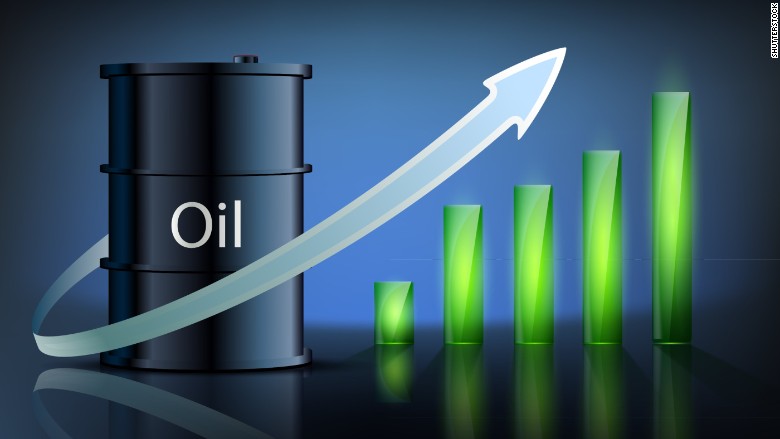

Consumers were hit hard by the increasing cost of gasoline as crude oil prices continued to climb at the start of the year. Many sectors, including transportation, consumer-goods manufacturers, and the food sector, rely on Petroleum as an input, so it's important to consider what will happen if the price of oil continues to rise. The average cost of a barrel of Brent crude oil increased significantly after the Russian invasion. It's a huge shift; this might mean that the low prices of previous years are not nearing an end any time soon.

Oil Companies

Most obviously, corporations actively engaged in the petroleum sector perceive a direct correlation between oil costs and profits. Exploration, extraction, refining, and marketing are just a few of the many components of the oil industry. Companies that operate higher up in the supply chain can be distinguished from those that operate lower down in the supply chain. Corporations in the upstream sector are those that conduct oil exploration and extraction. They are responsible for finding and evaluating suitable drilling locations, as well as preparing the infrastructure necessary for oil production. The finished goods, such as gasoline & diesel fuel, are refined and distributed by downstream enterprises.

Since the market determines the rate at which upstream firms sell their oil, yet those expenses are relatively stable, they suffer the most when oil prices drop. Producers will go bankrupt if a barrel of oil takes extra to generate than it is worth on the market. Smaller, more agile rigs may momentarily shut down and then resume as prices rise, while larger, more costly, and capital-intensive extraction projects are hit severely. Companies farther down the supply chain will be less affected since they make money when they buy crude oil and then sell the refined goods for more than they cost to produce. Despite the ups and downs in oil prices, they should be able to maintain a steady profit margin.

Currently, the majority of significant oil businesses include both upstream & downstream activities and are known as integrated oil corporations. Due to their engagement in upstream activities, the share values of these firms fell. The stock values of upstream-only enterprises, which lack a downstream component, fell even lower. Companies that are "pure plays" in the downstream value chain, meaning that they do nothing but refine and sell finished goods, did well during this time of low oil costs. Stock price changes over the course of six months for a selection of significant integrated and pure-play corporations during a time of declining oil prices are shown in the table below.

Integrated Oil | Upstream | Downstream |

Exxon Mobile -8.02% | Transocean -53.4% | Valero +6.11% |

Chevron -13.62% | Diamond Offshore -28.00% | Tesoro +46.41% |

British Petroleum -12.31% | Patterson-UTI Energy-47.02% | Phillips 66 -8.86% |

Total S.A. -17.18% | Nabors Industries -52.28% | Marathon Oil +14.45% |

Phillips 66 -8.58% | Anadarko Petroleum -23.48% | Alon USA Energy -8.09% |

Industrial Companies

Oil firms are not the only ones suffering from reduced oil prices. Manufacturers & industrial enterprises are also affected since they offer materials for oil extraction. Late in 2015, the oil industry did not launch any new initiatives and instead reduced output. The steel industry, the machinery & machine components sector, and the heavy machinery sector were all hit hard during the recession.

Some of the world's top steel makers, including U.S. Steel & ArcelorMittal, had their share prices fall by almost 30% between September 2014 & March 2015. Caterpillar, which provides large construction equipment and many other commercial autos to the oil sector, was down 18 percent during the same time. Shares of Halliburton, a conglomerate that provides oil field solutions to the energy sector, fell by 36.41 percent. Schlumberger, another oil services provider, fell by roughly 21 percent.

Financial Companies

Whenever oil costs are extremely high, many companies are willing to engage in costly new methods of oil extraction that they would never contemplate pursuing when oil was cheap. One prominent illustration of this phenomenon is the shale oil bonanza that occurred in the early 2000s and resulted in the United States being a net exporter of oil. Shale oil is significantly more expensive to produce. As a result of falling oil prices, several new drilling companies had to lay off personnel and reduce output. Some people have gone as far as to declare bankruptcy. Bondholders in this industry lost money when their holdings were downgraded.

When it comes to the loans they provide to the energy industry, the main participants in the banking sector in the United States are highly diversified & hedged. There was a heightened risk for several smaller financial institutions. Local banks in oil-producing areas were likely to feel the effects of the downturn initially. Since BNS sponsored many oil sand extraction projects in the period ending in February 2014, the bank's stock price has fallen by 19.12 percent. Over 10% of the loans held by the Texas bank Cullen/Frost Bankers were related to the oil industry, which contributed to its decline at that time. The stock price of Texas Capital Bank fell by about 7%.

Concluding Remarks

Companies in a wide variety of industries, not only the oil business, are impacted by the price of oil. Although crude oil prices have recently gone up, the impact on customers has been great and hard. However, astute financiers monitor the crude oil market's volatility. Every sector of the American economy feels the consequences of these swings.