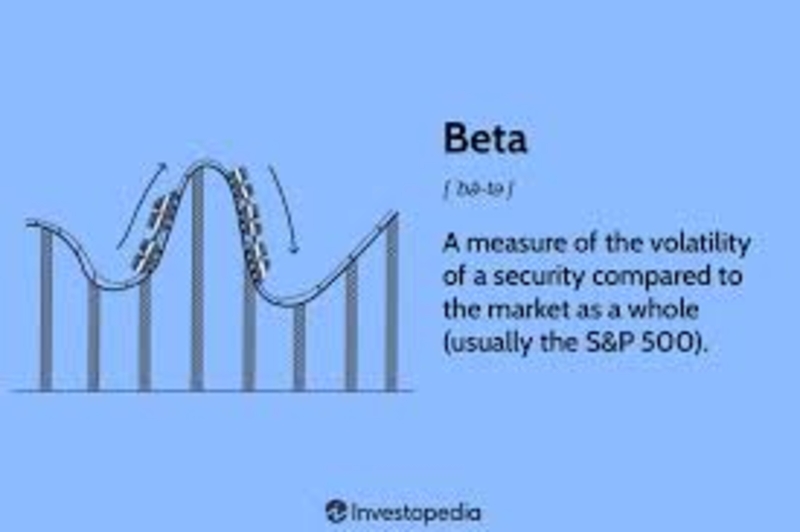

The beta or market sensitivity of a stock is an important concept for investors to understand. Beta measures the volatility of a stock in relation to the overall market, and it can help investors determine whether a stock is undervalued or overvalued relative to its peers. The calculation of beta requires two pieces of data: historical data on the share price movement of the subject company's stock, and a benchmark index that tracks the overall market. The beta is calculated by comparing the two data sets over a period of time – typically one year or longer – to determine how the share price of the company moves relative to the overall market.

Once investors have determined a company's beta, they can use it as part of their investment decision-making process. Generally speaking, stocks with higher betas are more volatile than those with lower betas. As such, investors may be willing to take on additional risk in exchange for the potential of greater returns when investing in a stock with high beta. Conversely, lower-beta stocks may offer investors a degree of safety and stability that is sometimes lacking in higher-beta stocks. It is important to note, however, that beta is not a guaranteed indicator of future stock performance and should be used in conjunction with other metrics when making an investment decision.

Benefits of Understanding and Utilizing Beta Formula:

Understanding and utilizing the beta formula provides significant advantages to investors. Firstly, high-beta stocks, while volatile, offer an opportunity for substantial returns. These stocks often fluctuate more intensely compared to the overall market, and with the right timing and analysis, investors can harvest fruitful gains. On the other hand, low-beta stocks offer a sense of stability and security. These stocks are typically less volatile than the market, making them an ideal consideration for conservative investors who prioritize preservation of capital over high returns.

The beta formula shouldn't be the sole determinant in investment decision-making. It's highly recommended to use it in conjunction with other financial metrics and indicators. This approach provides a holistic view of the investment landscape, empowering investors to make well-rounded decisions. This balanced approach to investing can enhance portfolio optimization, aid in risk management, and ultimately, increase the potential for profitable returns.

Higher Betas Offer Potential for Greater Returns:

Higher betas indeed offer potential for greater returns. A stock with a high-beta value suggests that it is more volatile than the market. This means that when the market rises, high-beta stocks tend to rise even more, providing an opportunity for significant gains. However, it's crucial to remember that this potential for considerable returns comes with an increased risk. During a market downturn, these stocks may lose value more rapidly than the overall market. Therefore, high-beta stocks can be a suitable choice for risk-tolerant investors who are aiming for higher returns and are comfortable with the accompanying volatility.

For lower-risk investors, it may be more prudent to select stocks with low betas in order to minimize the potential losses associated with a market downturn. In conclusion, beta is an important metric for investors when evaluating the volatility of a stock versus the overall market. By understanding and utilizing this formula, investors can identify opportunities for greater returns as well as suitable investments that can provide stability and security. With a balanced approach to investing, investors can increase their potential for profitable returns while minimizing risk.

Lower Betas Offer Stability and Security:

Investments with lower betas tend to offer stability and security for investors. Lower-beta stocks are typically less volatile than the market, meaning they tend to fluctuate less drastically in price. This results in a more predictable, steady rate of return, even amidst market turmoil. However, while these stocks may provide a safety net during turbulent market conditions, they may not provide substantial returns during a market upswing. They are often the choice for risk-averse investors who prioritize capital preservation and steady income over high returns. As always, the beta should not be the sole guiding principle in investment decisions, it's crucial to utilize other financial metrics and indicators to gain a comprehensive overview of a stock's potential performance.

By understanding and utilizing the beta formula, investors can identify investments that have a chance for high returns as well as those that offer stability and security. Through this balanced approach to investing, investors can optimize their portfolios and increase their potential for profitable returns while minimizing risk.

Conclusion:

The beta formula is an invaluable tool for investors, offering insight into stock volatility relative to the broader market. It can guide investment decisions by revealing opportunities for high returns with high-beta stocks, or stability and security with low-beta stocks. However, it's imperative to remember that it serves best when used alongside other financial metrics to present a holistic view of a stock's potential. By capitalizing on such comprehensive analysis, investors can optimize their portfolios, balancing potential for growth with risk management, and ultimately, enhancing profitability. This is a powerful tool in the hands of any investor who is interested in making sound investing decisions.

FAQs:

Q: What is the Beta formula?

The beta formula is a mathematical equation used to measure the volatility of a stock relative to the overall market. It is calculated by comparing its returns to those of an appropriate benchmark index, such as the S&P 500. The resulting number indicates how sensitive a stock's price movements are in comparison with the broader market. A stock with a beta of 1.0 is considered to have the same volatility as the overall market, while stocks with higher betas indicate greater volatility than the benchmark index. Stocks with lower betas are typically less volatile than the broader market.

Q: What are the benefits of understanding and utilizing Beta formula?

Understanding and utilizing the beta formula has many benefits. It can help investors identify opportunities for higher returns with stocks that have high betas, as well as stability and security with low-beta investments. It also enables them to build more balanced portfolios that combine potential for growth with risk management, ultimately enhancing profitability. In addition, the beta formula can provide a holistic view of the investment landscape, empowering investors to make well-rounded decisions. Thus, utilizing this metric is a powerful tool in the hands of any investor who is interested in making sound investing decisions.

Q: What is the difference between high and low Beta stocks?

High-beta stocks are typically more volatile than the overall market, meaning they tend to move more significantly in price when compared to the broader market. This can be beneficial during a market upswing as these stocks may provide an opportunity for greater returns. However, it's important to consider that higher betas come with an increased risk of loss during a market downturn. On the other hand, low-beta stocks are less volatile than the overall market and offer stability and security, with a more predictable rate of return.