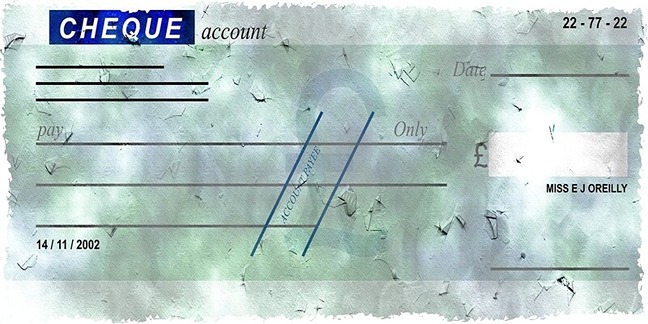

Writing a check is a simple process. To start, you’ll need to include the date, payee name, and amount of the check in numbers and words. When writing the payee name, always write it exactly as it appears on their official documentation. If you are making rent payments to someone named "John Smith," but their rental agreement indicates the name as "J. Smith," it is advisable to refer to them using the latter version. Additionally, to ensure accuracy, it is recommended to write the rental amount both as a numeral and in words. Once the check is filled out correctly, sign your name at the bottom right corner with blue or black ink. This signature authorizes the payment from your account. You can also include a memo line at the bottom left corner, which can provide further details about the payment.

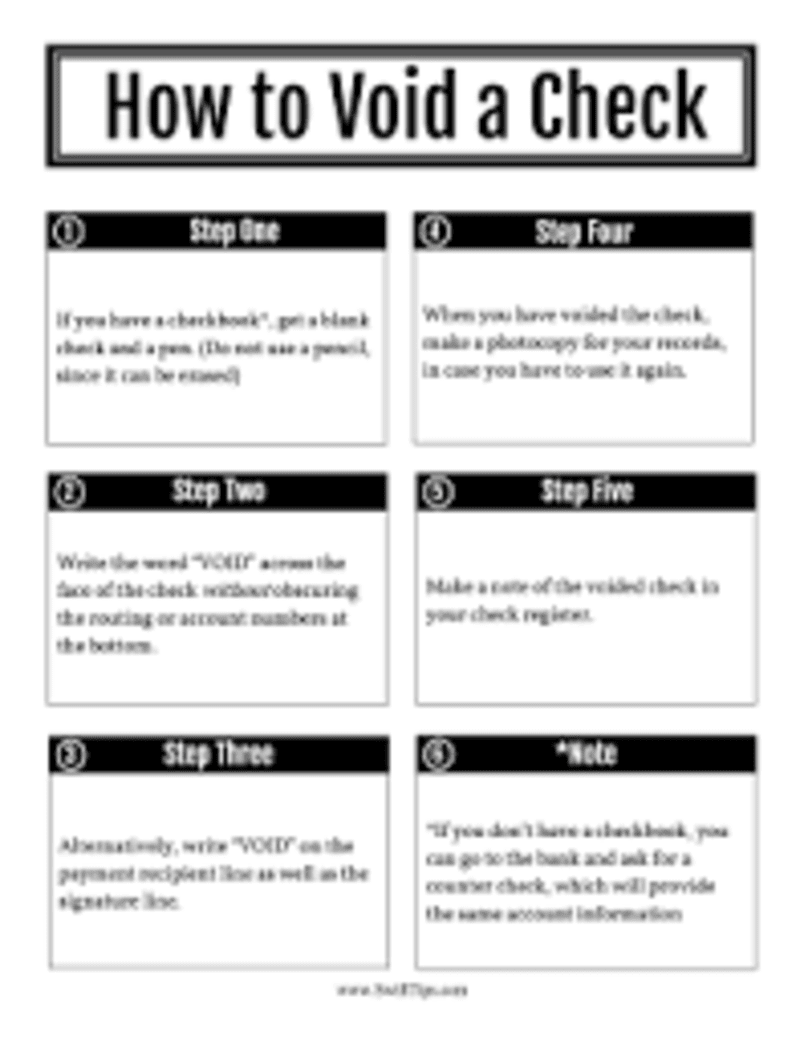

A voided check is just a regular check with “Void” written over it as a way of canceling it without actually making a payment. Voided checks are often used for setting up direct deposit and electronic bill payments. When you give someone or an institution a voided check, they can use the information on it to set up these electronic transactions. On the other hand, you won’t have to worry about anyone else being able to cash the check or make any payments from your account without your permission. Having a voided check also makes it easier for employers and banks to verify that someone is who they say they are, as it can be used to check an individual’s information. However, it is important to remember that voided checks should always be kept safe and secure in order to protect against potential identity theft.

The Basics of Writing a Check:

Date:

Usually found in the upper right corner of the check, the date should indicate the day you write the check, rather than the date of the transaction or a future date.

Payee:

This is for the person or organization to whom you are writing the check. Be sure to use their full, official name.

Amount:

Write the amount of the check in two places. First in a numeral form in the box on the right, and then in words on the line beneath the payee's name. If there's any space left after writing the amount in words, draw a straight line to prevent anyone from increasing the amount.

Signature:

Your signature goes on the line at the bottom right corner of the check. This is your approval for the bank to process the check.

Memo:

While this line is optional, it is often used to denote what the check is for, such as 'Rent for March' or 'Birthday gift'.

Check Number:

Every check comes with a unique number located in the top right corner. This helps you and the bank keep track of your transactions.

Benefits for How to Write a Check and Uses for a Voided Check:

Control Over Payments:

Writing a check allows you to retain a record of the payment, which can be useful for budgeting and financial tracking purposes. It allows you to control exactly when the funds are withdrawn from your account as it's only done when the recipient deposits or cashes the check.

Convenience:

Checks can be written and sent at any time, making them a convenient method of payment, especially for sizable amounts that might exceed card transaction limits.

Security:

Checks are a secure form of payment as they can only be cashed or deposited by the intended recipient, reducing the risk of theft.

Setting Up Transactions:

Voided checks are typically used to set up direct deposit or automatic bill payments, enabling hassle-free and timely transactions.

Verification:

Voided checks can serve as a proof of identity and ownership of a bank account, simplifying the verification process for employers or financial institutions.

Privacy:

By using a voided check to set up transactions, you avoid having to share sensitive bank account information verbally or through less secure methods.

Conclusion:

Understanding how to write a check and the uses of a voided check can encourage better control over your financial transactions and enable a seamless setup of electronic payments. It grants you the convenience and security you need in dealing with sizable amounts or recurring transactions. Furthermore, the use of voided checks can assist in maintaining your privacy while proving your identity and bank account ownership. Therefore, mastering these basic banking procedures can empower you to handle your finances with confidence and ease. Always remember to treat every check, whether active or voided, with care to ensure your financial information is protected

FAQs:

Q: What is a voided check?

A voided check is a regular check with the word “Void” written over it to cancel it without actually making the payment. It can be used for setting up direct deposit or automatic bill payments, verifying identity, and other financial transactions.

Q: What should I include when writing a check?

When writing a check, you should include the date, payee name, and amount of the check both as a numeral and in words. You should also sign your name at the bottom right corner and can include a memo line at the bottom left corner.

Q: How do I use a voided check for direct deposit?

When giving someone or an institution a voided check, they can use the information on it to set up electronic transactions such as direct deposits or automatic bill payments. This eliminates the need to share sensitive bank account information verbally or through less secure methods.