One thing that almost everyone in America wants is to earn more money while also decreasing their tax burden. Increases in discretionary income may have profound effects on one's quality of life, but only if those funds are put to good use. Here are several strategies for increasing one's disposal income, as well as a potentially game-changing approach to put that additional cash to work for long-term financial stability.

What Is Disposable Income?

The term "disposable income" refers to the sum of money you have after paying all applicable taxes (federal, state, and local). If you make $100,000 per year but must pay $25,000 in taxes and other fees, your take-home pay is $75,000. Money that may be spent at will is different from income that must be earned. The term "discretionary income" refers to the sum of money left over after basic needs such as food, shelter, and clothing have been met. Therefore, a person's iPhone, trip, and even their late-night coffee purchase are all possible because of their discretionary money.

Tips To Increase Disposable Income

University is costly no matter how you spend it. Therefore most students have experienced financial hardship. It always feels like there isn't enough money to cover everything, whether it is books or going out. The ability to enhance one's discretionary income is an asset in both the present and the future, and it is thus wise to acquire this skill early on. How to Increase Your Income While Attending College

Working Part-Time

For some individuals, getting a job is the best place to start, but obviously, this isn't true for everyone. While doing a second job might assist with expenses, it can be taxing on your body and mind, particularly if you're a student. Prioritizing your academics should be your first priority, so before taking on any extra work, check in with your school's calendar to see when classes are in session.

Purchase Used Stuff

One approach to free up more cash is to cut less on costly shopping excursions. If you're not prepared to cut down on your spending, secondhand shopping is a smart and sustainable alternative. This may be done in person at any of your local charity shops or on the internet at sites like eBay and Depop. Find one-of-a-kind treasures that won't break the bank and will liven up any space or closet.

Alternative Transport

Saving money on transportation costs is a terrific way to put more money in your pocket. Taking public transportation, walking, biking, or carpooling with friends might help you save a lot of money on your commute to and from college. Used bicycles are an excellent way to minimize your impact on the environment, and they're simple to get by.

Selling Items

Selling items you no longer need is a terrific method to generate extra cash flow. Clothing, home decor, literature, and other works of art are all fair game if you're an artisan. If you have a knack for crafting one-of-a-kind goods, selling them online might be a fun and profitable side hustle. Start by selling your wares on websites like Etsy, Depop, or Facebook's Marketplace.

Investing A Profit

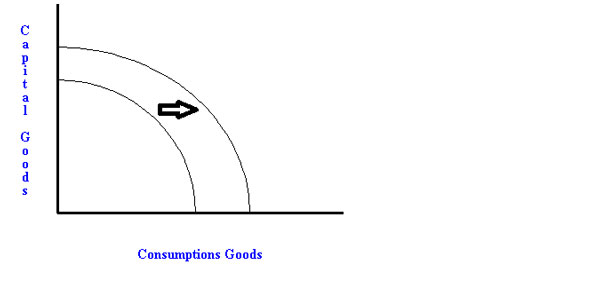

The ability to retire with a comfortable nest egg may be greatly improved by making even modest adjustments to one's income or tax position. For instance, between the ages of 35 and 44, the typical American invests $61,500 across various accounts such as 401(k)s, IRAs, and stocks and shares. A 40-year-old with that amount and a hypothetical 6% annualized return would have $395,624 in their account when they reach retirement age. If, however, the same person's discretionary income was to double, allowing them to raise their investment to $500 each month, their portfolio would grow to $593,137. If you save $300 more each month, you will have an extra $197,513 in your retirement fund.

Tying It Together

These are simply a few of the numerous options available to you if you want to improve your discretionary income, but remember that it is how you choose to invest that money that will determine whether or not you reach your long-term financial objectives. As a result, rather than blowing your windfall on frivolous purchases, you could be better off boosting your regular savings.

Conclusion

Simple solutions are sometimes the most effective, and one of them is just increasing your discretionary cash. Reduced spending and increased savings may be used in tandem with any of the other tactics. It's also the only option that won't force you to spend additional time or money.