The insurance and annuity products of Athene Annuity and Life Company. This firm has called Des Moines, Iowa home since its inception in 2009. In addition to life insurance policies, the firm also provides fixed annuities and variable annuities. Financial advisers and intermediaries may make use of Athene's product offerings and assistance. In 2021, the firm will have managed assets of over $100 billion. As of March 2022, Apollo Global Management, the world's foremost alternative asset manager, has around 500 billion dollars worth of assets under management. Athene is a branch of Apollo Global Management.

How Does Athene Annuity Work?

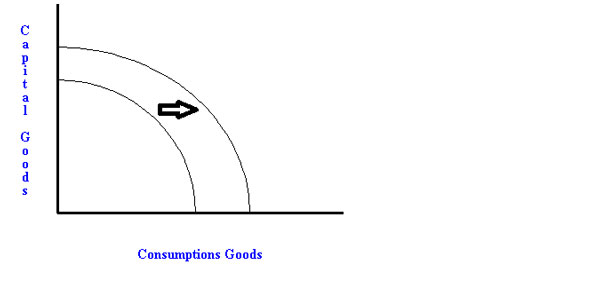

Income in retirement, tax-deferred savings, and even estate planning are just a few of the many possible applications for an annuity from Athene. Independent financial advisors are the primary channel for product distribution (like The Annuity Expert). Fixed Indexed Annuities from Athene let you grow your money tax-free based on one or more underlying indexes while protecting you from market drops. Additionally, offer competitive lifetime income possibilities. Guaranteed growth at a fixed interest rate (similar to a CD rate) and protection against stock market loss are only two of the benefits of Athene's Fixed Annuities (optional).

Third-Party Ratings

Independent reviews of a carrier's dependability and quality of service are helpful. AM Best is a highly respected rating agency that provides a letter grade (between A++ and D) for a company's financial stability. Customers may learn a lot about the company's reliability and future prospects from this financial strength grade. There is more confidence in the company's capacity to meet its financial obligations if the grade is high. At now, Athene has been assigned AM Best's third-highest possible grade of A (Excellent). J.D. Power, a recognized leader in customer satisfaction research, also provides an independent rating. According to the 2021 Individual Annuity Study, out of a total of twelve annuity providers, Athene came up at number seven in terms of client satisfaction, products offered, price, and availability.

Cancellation Policy

A penalty may be imposed for early annuity withdrawal. There may be significant penalties and withdrawal costs associated with early withdrawal from an annuity, depending on the kind of annuity, the riders selected, and the length of time the plan has been held. You may be required to pay a 10% penalty if you remove funds from your annuity before you become 59 12. Early contract cancellation may also result in surrender costs.

Price

There is no medical exam or medical history review with an annuity, which makes them operate a little differently than life insurance. Consequently, anybody who is able to pay the required initial payment may apply for and get a guaranteed issue annuity. How much and for how long you want to be protected by the annuity will determine the annuity's cost was going forward. For certain annuities, you may make a single large payment, but for others, you'll need to make recurring payments. If you invest more money into your annuity and it grows, you'll have a larger stream of income in retirement for a longer time.

Competition

How does Athene compare to other top annuity companies? In order to assist you in making a more informed decision, we have compared them to Fidelity, another highly regarded annuity provider. Athene has more annuity choices (twelve) than Fidelity has (six). When compared to Fidelity, which has been around since 1946, Athene is a much younger firm, having been established in 2009. Athene's minimum commitment is $10,000, whereas Fidelity's deferred annuity program requires just a $5,000 initial deposit.

Why Do We Like Athene Annuities?

- The options available from Athene Annuity allow for early withdrawal without penalty, accumulation of cash value, and refund of premium.

- Products from Athene Annuity may provide premium incentives of up to 20% and protect against market declines.

- Products from Athene Annuity may do things like guaranteeing a certain amount of money each year or after death. To assist keep up with rising costs, the lifetime income riders may offer a steadily growing cash stream. Family members may feel more secure knowing they are covered by the increased death payments.

- The products provided by Athene Annuity are geared at providing growth potential through an index's performance (such as the Nasdaq FC or S&P 500) while also providing some downside protection.

Conclusion

Athene is a new firm that has only been around since 2009. Previously, it sold both life insurance and annuities, but today it solely offers annuities. When it comes to retirement planning, Athene's 12 available annuities provide a wide range of options at a low entry price point of $10,000.