Are you trying to decide between investing in an ETF or a mutual fund? With so many different investment products and strategies out there, it can be overwhelming to make the right choice. It’s important that before diving into any type of financial product, you understand the key differences between them and how they interact with your portfolio. This blog post will help you learn more about ETFs vs mutual funds and help equip you with the knowledge necessary to make a confident decision on which one is right for your investment strategy. Here we’ll explore what both ETFs and mutual funds are, how they differ from each other, their advantages & disadvantages, where tax considerations come into play, as well as discuss who might benefit most from using these two types of funded investments.

What are ETFs?

ETF stands for Exchange-Traded Fund. An ETF is a basket of securities such as stocks, bonds or commodities that tracks an underlying index, allowing investors to buy and sell shares on an exchange like stocks. This means that the price of an ETF will fluctuate throughout the day as it is bought and sold on the market. The goal of an ETF is to generally replicate the performance of its underlying index. There are many different ETFs available in the market, each with a specific investment objective or strategy.

Ideal scenarios for investing in ETFs

ETFs are a good choice for investors who want to diversify their portfolio by gaining exposure to a wide range of assets within a single investment. This is because ETFs offer instant diversification, as they hold multiple underlying securities.

Advantages of ETFs

- Lower fees: ETFs typically have lower expense ratios compared to mutual funds, which mean investor can keeps more of returns.

- Flexibility: As mentioned earlier, ETFs can be bought and sold throughout the day, giving investors more flexibility in managing their investments.

- Diversification: With an ETF, you can get exposure to a wide range of assets with just one investment, providing instant diversification for your portfolio.

Disadvantages of ETFs

- Liquidity: Although ETFs can be bought and sold throughout the day, it’s important to keep in mind that they may not have the same level of liquidity as stocks. This means that there may not always be a buyer or seller readily available on the market, which could impact your ability to buy or sell at your desired price.

- Trading fees: Depending on your broker, there may be trading fees associated with buying or selling ETFs, which could impact your overall returns.

What are Mutual Funds?

A mutual fund is a pooled investment vehicle that allows investors to pool their money and invest in a portfolio of stocks, bonds or other securities. The fund is managed by a professional fund manager who makes the investment decisions on behalf of the investors. Unlike ETFs, mutual funds are not traded on an exchange and can only be bought or sold at the end of each day based on the fund’s Net Asset Value (NAV).

Ideal scenarios for investing in Mutual Funds

Mutual funds are a good choice for investors who prefer a more hands-off approach to investing. With mutual funds, the fund manager takes on the responsibility of selecting and managing investments, making it a more passive investment option for investors. Mutual funds also offer access to professional management and diversification through various asset types.

Advantages of Mutual Funds

- Professional management: By investing in a mutual fund, you are entrusting your money to a professional fund manager who has expertise in managing investments.

- Diversification: Mutual funds offer access to a diversified portfolio of securities, which can help mitigate risk and provide more stable returns.

- Ease of use: Mutual funds are relatively easy to buy and sell, as they only require one transaction at the end of each day when the market closes.

Disadvantages of Mutual Funds

- Higher fees: Mutual funds generally have higher expense ratios compared to ETFs, which can eat into your overall returns.

- Less tax-efficient: Since mutual funds are actively managed and have a higher turnover rate, they tend to generate more taxable capital gains for investors.

- Lack of flexibility: Unlike ETFs, mutual funds cannot be bought or sold throughout the day, which means you may have to wait until the end of the trading day to make a transaction.

ETFs vs Mutual Funds: Key Differences

- Trading: As mentioned earlier, ETFs can be bought and sold throughout the day like stocks, while mutual funds can only be traded at the end of each day based on their NAV.

- Diversification: Both ETFs and mutual funds offer diversification, but with ETFs you can get exposure to a wider range of assets within one investment.

Tax Considerations for ETFs and Mutual Funds

Both ETFs and mutual funds may have tax implications for investors. In general, any capital gains or dividends received from these investments are subject to taxes. However, due to their different structures and management styles, the tax implications can differ between ETFs and mutual funds.

ETFs tend to be more tax-efficient because they track an index and do not have as much turnover, meaning they have fewer taxable events. On the other hand, mutual funds are actively managed and may experience more taxable capital gains for investors.

It’s important to consult with a tax advisor or do your own research to understand the potential tax implications of investing in ETFs or mutual funds before making any investment decisions. Overall, both ETFs and mutual funds can be valuable investment options for investors, each with their own advantages and disadvantages.

Conclusion

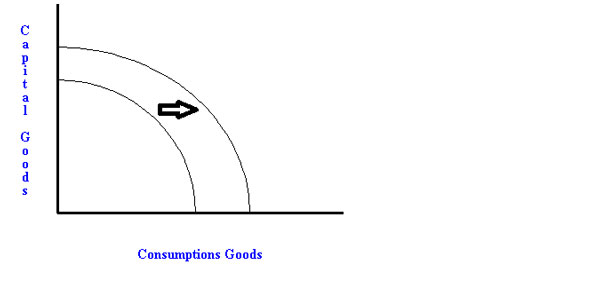

ETFs and mutual funds are both popular investment options for investors looking to diversify their portfolio. While they have some similarities, such as offering access to a diversified portfolio of securities, there are also key differences that investors should be aware of. ETFs offer convenience and cost-effectiveness, while mutual funds offer professional management and ease of use. When considering whether to invest in ETFs or mutual funds, it’s important to understand your investment goals and risk tolerance.