Introduction

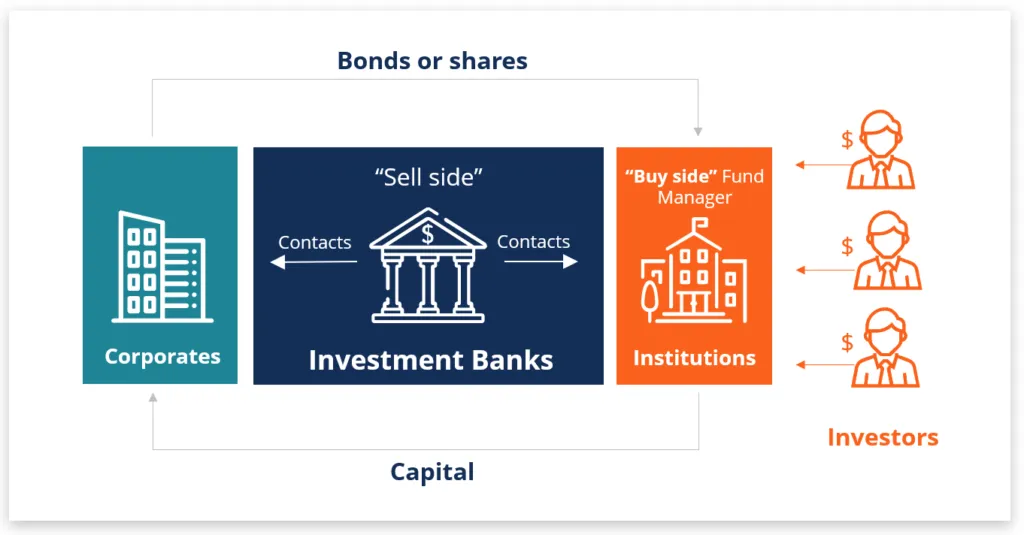

JPMorgan Chase, Bank of America, Wells Fargo, and Citi are among the top investment banking firms in the United States. According to the Federal Reserve's data on consolidated assets, these investment banks are the largest in the United States. Shares of stock, loan balances, property holdings, and cash reserves are all components of a consolidated asset portfolio. Investment banking is a global industry because it helps large corporations and governments raise capital. Many of the largest investment banks in the world are not headquartered in the United States, but they still control a sizable share of the market there.

Goldman Sachs

If you're looking for a prestigious investment bank, look no further than Goldman Sachs. Publicly traded since 1868, by the end of 2021, it was managing $2.5 trillion in assets. 12 Goldman has hosted several government leaders, including some in high positions. U.S. Treasury secretaries, White House aides, international government and central bank heads are among them. That makes it one of Wall Street's most influential centres. The financial institution has been at the centre of its share of scandals, including its role in the financial crisis of 2008, but it also participates in numerous community-oriented projects. Financial advising and underwriting, in-house investment and loan portfolios, institutional investor services, investment management, private equity, and other divisions like these are only a few of the company's many offerings. The company also runs Marcus, an online consumer bank outside the investment banking industry.

JPMorgan Chase

JPMorgan Chase has approximately 5,000 locations in the United States, and its consolidated assets total $3.5 trillion. The Chase Manhattan Corporation and J.P. Morgan & Co. merged in December 2000 to become JPMorgan Chase, a global banking institution dating back to the 18th century. Investment banking, asset management, credit cards, and retail banking are just some financial products and services that JPMorgan Chase now provides.

Morgan Stanley

Morgan Stanley is widely recognised as a premier global financial services firm. Having its name on your CV will give you more options as your career progresses. Morgan Stanley excels in mergers and acquisitions, initial public offerings, investment management, and wealth management on a global scale. It also has a solid commitment to charitable work, especially helping children or people in desperate financial straits. The company has recently made significant progress toward building a more diverse workforce.

Evercore

Evercore is a leading mergers and acquisitions (M&A) and corporate restructuring (restructuring) advisory firm. It regularly assists clients like GE, Fubo, and Verizon in negotiating and closing massive, high-profile investment banking deals. Junior bankers and interns can gain invaluable experience working alongside seasoned professionals at this firm. And the emphasis is on making everyone feel welcome. Groups for women, members of the LGBTQ community, members of historically underrepresented groups, and veterans are all well-established and actively participate in the community.

Centerview Partners

Centerview is regarded as one of the best merger and acquisition advisory firms on Wall Street. Its high-profile clients include CBS, CVS Health, and Time Warner. Centerview is well-known for its generous employee compensation. We offer competitive salaries and bonuses, comprehensive health insurance, and a wide range of other benefits, including complimentary breakfast, catered lunches, and generous dinner stipends. The company has recently made a concerted effort to strengthen its recruitment of underrepresented groups.

Barclays

Barclays is a well-known British financial institution that is not as well-known in the United States. Barclays, with its headquarters in London and a current asset value of £1.4 trillion (roughly USD 1.9 trillion), was established in 1690. American customers of Barclays credit cards may already know that the bank is working on a consumer banking service. It is highly represented in New York and other global financial hubs outside Europe. After acquiring Lehman Brothers in 2008, Barclays made significant inroads into the U.S. investment banking market. Like many other investment banks, Barclays has a chequered past, has faced scrutiny for its compliance during the Lehman acquisition and grabbed headlines in 2012 for its involvement in the LIBOR scandal. 78 Despite this, it is still one of the world's largest and most prestigious investment banks.

How To Get A Job At One Of The Top Investment Banks

We have released the definitive guide on how to break into the investment banking industry. Doing as much networking as possible is a great way to get your foot in the door. As a result of the large number of people who apply to work at banks, having a connection already there can be helpful.

Conclusion:

It is through the commissions and fees that investment banks make their money. To do anything like selling shares of stock to the public, you'll need the services of an investment bank. There will be costs associated with the investment bank's assistance in bringing your company's stock to the public market.