Introduction

Dow Jones Industrial Average vs S&P 500 are among the most watched stock market indices in the United States. Many market observers have a preference for one over the other, yet they both serve the same function of showing how much the stock market as a whole is rising, falling or staying about the same. Both indexes are calculated by monitoring the changes in the value of a selected equities group. Each picks its stock list and employs its process, with some overlap.

Indicator of Industrial Performance of the Dow

The DJIA was the first stock market index to gain widespread recognition and has maintained that position ever since. There are now 18 stocks in the index, up from the original 12 in 1896. The word "industrial" in the name of the index is misleading because most of its stocks have nothing to do with production. Instead, they are all-encompassing economic indicators, except for the utilities and transportation sectors, which are represented by their individual Dow Jones indices. The Dow Jones standards for admittance of a corporation are not clearly defined. These corporations are all industry heavyweights and market behemoths. Values of stocks making up the DJIA hardly ever change. Company additions and removals are not made flippantly. The committee that oversees the index may decide to delist many companies at once should the need arise.

The Formula Used to Calculate the Dow's Averages

The DJIA uses a price-weighted formula to determine the relative importance of each component. This divisor smoothes out changes in the stock price due to dividends and stock splits. Since the DJIA is only affected by changes in stock prices, companies with a higher share price or a more extreme price fluctuation have a more significant effect on the DJIA.

S&P 500

A measure of the 500 most actively traded stocks in the United States, the S&P 500 Index debuted in 1957. Stocks in this index were chosen to be representative of many different sectors. Stocks are evaluated for inclusion if they have a market capitalization of at least $14.6 billion, a public float of at least 10%, a quarterly profits growth rate of at least 20% over the most recent four quarters, and sufficient liquidity (as evidenced by price and volume).

Determine the Formula for the S&P's Weighting

Stocks in the S&P 500 are included not based on price but their total market value. The hope of the S&P 500 is that all stores, regardless of price, will contribute equally to the index's performance.

Which Is the Best Investment: The S&P 500 or the Dow?

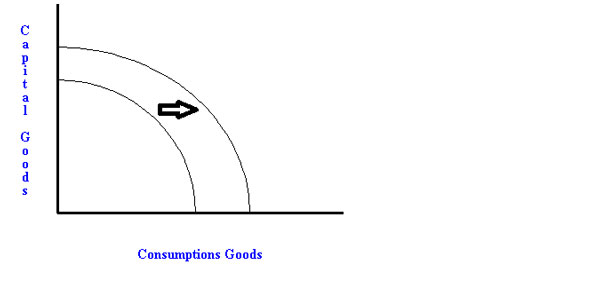

There is a close relationship between the index valuations in all three markets. As a result, the three usually move in the same direction. However, the size of the profits or losses varies from index to index. You should choose an index to invest in based on your investment strategy and long-term objectives. To participate in the growth of a large portion of the market, the S&P 500 is your best chance. However, the Dow is a fantastic alternative if you want a risk-free strategy that tracks the price changes of large, well-known companies. However, picking an index isn't a purely competitive process. Few equities appear on all three price guides. If the sector is trending upwards in the economy, the stock price will reflect this.

Although they track each other's price changes closely, different indexes generate unique returns depending on the economy and market conditions. The S&P 500 gained 12.8% in the 2010 bull market, while the DJIA increased 11%. An increase in the proportion of small stocks within the S&P 500, which are particularly popular among investors during bull markets, was the primary contributor to the index's increased value in 2010. However, because of the index's disproportionate weighting of tiny businesses, the S&P 500 tends to decline in value when economic uncertainty rises and investors seek the security and dividends offered by Dow components.

Conclusion

The S&P 500 is more comprehensive than the DJIA since it is based on a more significant proportion of publicly traded companies in the United States. The S&P 500 and the Dow Jones Industrial Average are two different types of market indexes. The indices tend to follow one another in the same direction even if they have diverse origins, inclusion criteria, and sectoral makeup.